Why long-term disability (LTD) insurance?LTD can help protect you and your loved ones financially if you're unable to work for an extended time due to sickness, injury or surgery. |

|

How does it work? LTD insurance replaces a portion of your income if you're unable to work for longer than a specified number of days (see plan details). When you elect this coverage, you receive a monthly payment to replace some of the income you would earn if you were working. |

|

What can the money be used for? Use sick leave or paid time off to first cover the elimination period — a set time frame based on your policy. After that, you receive a portion of your weekly salary as a cash benefit to help ease the financial burden while you’re away from work. |

Get the protection you need

Don’t miss the opportunity to protect your loved ones … and yourself. Your employer offers these group benefits at affordable rates. Take advantage of modest costs while enjoying the convenience and confidence of coverage. Now's the time to consider your options and enroll in the benefits that are right for you.

-

Long-term disability insurance -

Short-term disability insurance -

Critical illness insurance -

Benefit Summaries -

Contact us

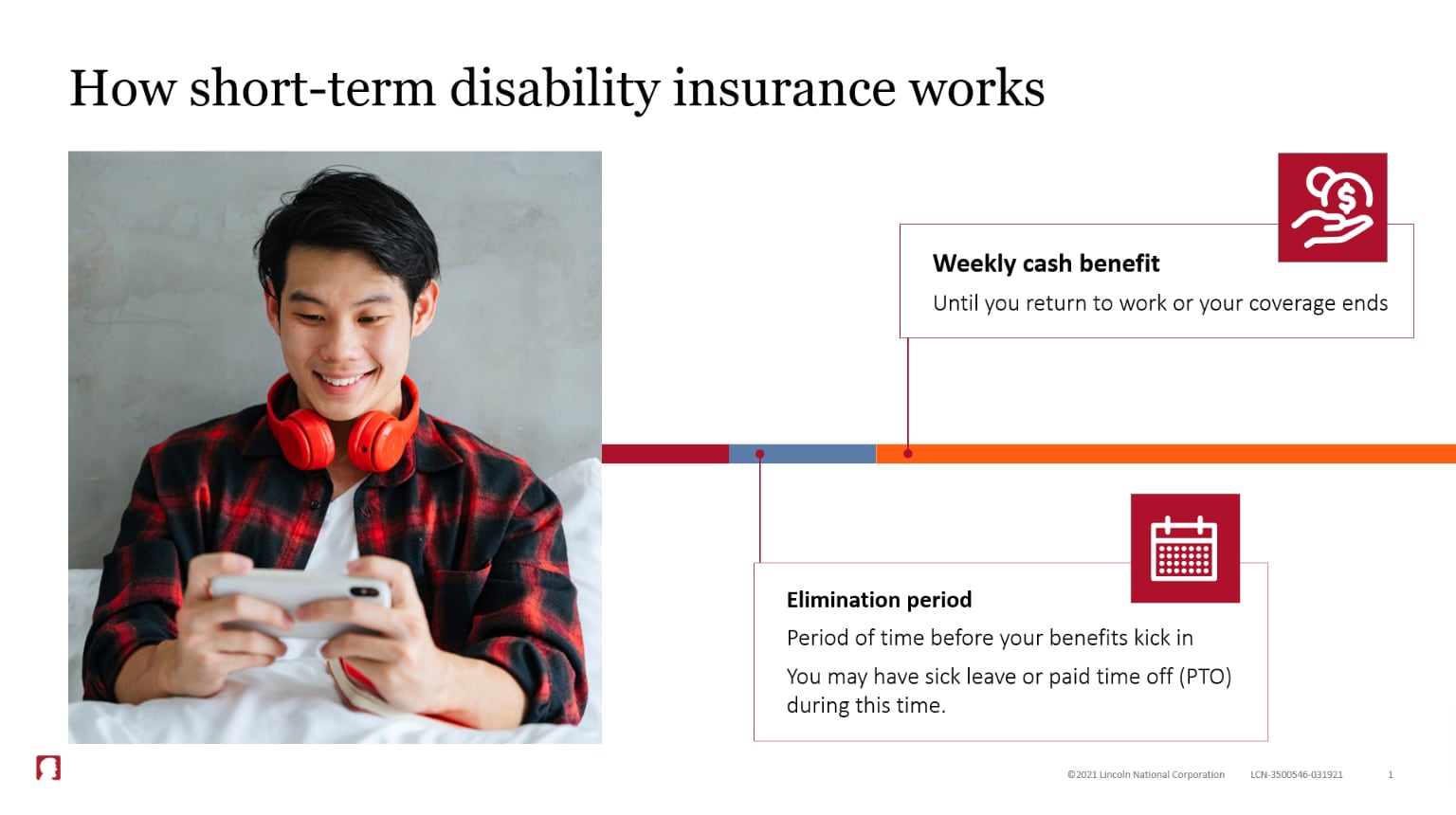

Why short-term disability (STD) insurance?STD insurance can help financially protect you and your loved ones if you're unable to work due to sickness, injury, surgery or recovery from childbirth. |

|

How does it work? STD insurance replaces a portion of your income if you’re unable to work for a short period (see plan details). When you elect this coverage, you receive a monthly payment to replace some of the income you would earn if you were working. |

|

What can the money be used for? Use sick leave or paid time off to first cover the elimination period — a set time frame based on your policy. After that, you receive a portion of your weekly salary as a cash benefit to help ease the financial burden while you’re away from work. |

Why critical illness insurance?Now you can take an important step to protect yourself and your loved ones should you experience a serious illness. Critical illness coverage provides a lump-sum cash benefit for health events such as a heart attack, stroke or cancer and can provide additional cash to pay for expenses that may arise. |

|

What can the money be used for? Use it for anything, including medical expenses such as deductibles and copays, travel and lodging for specialty treatment facilities or everyday expenses like groceries. |

Contact Information

County of San Diego Contact InformationEmployee Benefits Division |

Lincoln Financial Group Contact InformationCustomer Service Center Phone: 1-888-480-8710 Web: LincolnFinancial.com |

- All disability/leave benefits paid by LFG are not taxable and LFG mails W2s/1099s for the prior year by 1/31.

- LFG mails W2s to employee homes for the paid family leave (PFL) by January 31st of the preceding year, and

- LFG mails W2s to employee homes for long term disability (LTD) by January 31st of the preceding year.

- To request a replacement copy of your W2, email gptaxhelp@lfg.com with your SSN and mailing address