All new Lincoln Level Advantage® rate center

-

Overview -

Investor options -

Videos and resources

BRINGING PROTECTION AND GROWTH INTO BALANCE CAN BE A CHALLENGE — BUT IT'S POSSIBLE

When it comes to investing with confidence, it’s about finding the balance that’s right for you.

-

STAY INVESTED

Upside potential with the flexibility to lock in performance

-

REDUCE RISK

Levels of protection to help guard against downturns

-

PAY LESS

No explicit costs so you can save more of what you earn

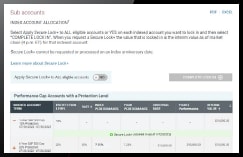

Lock it in and level up with Secure Lock+®

Bring predictability and opportunity to your investment with this feature -- available exclusively with Lincoln Level Advantage 2®.

Access your account

Your online account provides secure and convenient access to information and resources including an up-to-the-day snapshot with Statement on Demand.

INDEXED ACCOUNTS — FOR GROWTH POTENTIAL WITH DOWNSIDE PROTECTION

Customizable to fit a broad range of investment objectives and investing styles. You can allocate to one or a combination of indexed accounts

State and firm availability: Lincoln Level Advantage 2® index-linked annuity is not available in all states and firms. In some cases, Lincoln Level Advantage® indexed variable annuity is offered. Select the option available to you.

- Lincoln Level Advantage 2®

- Lincoln Level Advantage®

-

Capture investing performance with Secure Lock+®

See how it works -

Bring protection and growth into balance with the 1-year and 6-year indexed account

See how it works

-

Get greater potential returns with the participation rate account

See how it works

-

Have greater predictability with the performance trigger account

See how it works

-

Potential upside – even on the downside with the dual performance trigger

See how it works

-

Potential to stay positive – even when the market is negative with Dual15 Plus

See how it works

-

Lock in market performance with the annual lock account

See how it works

-

Bring protection and growth into balance with the 1-year and 6-year indexed account

See how it works

-

Get greater potential returns with the participation rate account

See how it works

-

Have greater predictability with the performance trigger account

See how it works

-

Potential upside – even on the downside with the dual performance trigger

See how it works

-

Potential to stay positive – even when the market is negative with Dual15 Plus

See how it works

-

Lock in market performance with the annual lock account

See how it works

Learn more about how this solution helps bring protection and growth into balance.

State and firm availability: Lincoln Level Advantage 2® index-linked annuity is not available in all states and firms. In some cases, Lincoln Level Advantage® indexed variable annuity is offered. Select the option available to you.

- Lincoln Level Advantage 2®

- Lincoln Level Advantage®

Watch videos to learn more about the indexed account options

-

Secure Lock+

Capture performance and reset protection -

Performance cap

Protection and growth -

Performance trigger

Greater predictability -

Participation rate

Market growth opportunities -

Dual performance trigger

Potential positive returns in negative markets -

Dual15 Plus

Potential positive returns in negative markets -

6-year annual lock

Capture performance and reset protection each year

Featured resources

News and highlights

- Lincoln Financial Group strengthens its award winning Registered Index Linked Annuity, launches Lincoln Level Advantage 2®

- Lincoln Financial Group named 2023 "Best Variable Index Annuity Carrier" by Structured Retail Products Americas

- Learn about the financial strength and history of Lincoln Financial

Watch videos to learn more about the indexed account options

-

Performance cap

Protection and growth -

Performance trigger

Greater predictability -

Participation rate

Market growth opportunities -

Dual performance trigger

Potential positive returns in negative markets -

Dual15 Plus

Potential positive returns in negative markets -

6-year annual lock

Capture performance and reset protection each year

LLA Featured resources

1Barclay’s Monthly Index Recap, Jan. 2, 2025. Excluding funds that target volatility levels.

Important information

Lincoln Level Advantage 2® index-linked annuity and the components and features contained within are not available in all states and firms.

In some cases, Lincoln Level Advantage® indexed variable annuity is offered.

This material is authorized for use only when preceded or accompanied by a prospectus, which describes investment objectives, risk factors, fees and charges that may apply as well as other important information. Please read the prospectus carefully before you invest in Lincoln Level Advantage 2® index-linked annuity or send money. The prospectus can be obtained by clicking here or calling 888-868-2583.

Lincoln Level Advantage® indexed variable and Lincoln Level Advantage 2® index-linked annuities are long-term investment products designed for retirement purposes. There are no explicit fees associated with the index-linked account options available. With Lincoln Level Advantage® indexed variable annuity there are associated fees with the variable annuity subaccounts, which include a product charge, and administrative fees. Annuities are subject to market risk including loss of principal. Withdrawals are subject to ordinary income tax treatment and, if taken prior to age 59½ in nonqualified contracts, may be subject to an additional 10% federal tax.

Any distribution or transfer from an indexed account (other than on the term end date) is based on the interim value of each indexed segment. This value is based on a formula and may not correspond to the current performance of the index you selected. Any distribution or transfer during a term will have a negative impact on the value at the end of the term. This reduction could be larger than the dollar amount of the distribution or transfer. See prospectus for details.

The risk of loss occurs each time you move into a new indexed account. If the negative return is in excess of the protection level selected, there is a risk of loss of principal. Protection levels that vary based on the index, term, and crediting strategy selected are subject to change and may not be available with every option. Please see the prospectus for details.

There are no explicit fees associated with the index-linked account options available. Annuities are long-term investment products that offer tax-deferred growth, access to a lifetime income stream, and death benefit protection. To decide if either of these products are right for you, consider that its value will fluctuate; it is subject to investment risk and possible loss of principal; and there are costs associated with the variable investment options such as product charges. All guarantees, including those for optional features, and all amounts invested into the indexed accounts are subject to the claims paying ability of the issuer. Limitations and conditions apply.

Investors are advised to consider the investment objectives, risks, and charges and expenses of the annuity and its underlying investment options carefully before investing in Lincoln Level Advantage® indexed variable annuity. The applicable prospectuses for the variable annuity and its underlying investment options contain this and other important information. Please call 888‑868‑2583 for free prospectuses. Read them carefully before investing or sending money. Products and features are subject to state availability.

All contract and rider guarantees, including those for optional benefits, payment from the indexed accounts, or annuity payout rates, are backed by the claims-paying ability of the issuing insurance company. They are not backed by any selling entity other than the issuing affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.