How do we turn non-participants into participants? It may be easier than you think. Half of non-participants have contributed to a retirement plan in the past, including 17% who contributed to their current employer’s plan. In fact, 14% stopped contributing in the past year. These former savers may only need a small nudge to get back on track.

See what employees want to know about in-plan income and how you can answer their questions.

Non-participants told us how to encourage them to enroll, and the answers are clear. Auto enrollment, employer match, and in-plan income options are strong motivators.

62% of non-participants

would likely stay in the plan if their employer auto-enrolled everyone not currently contributing

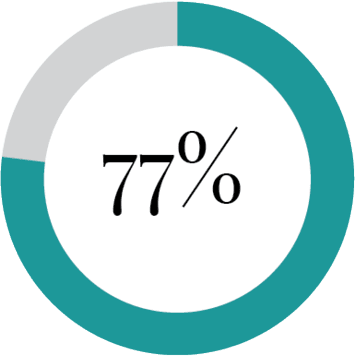

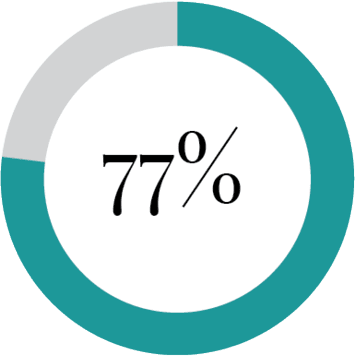

77% of non-participants

would be likely to save in the plan if a 3% match were offered

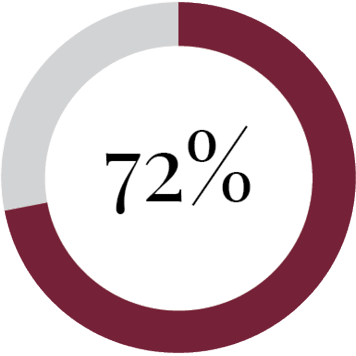

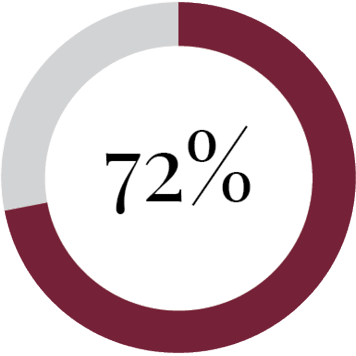

72% of non-participants

say a guaranteed income option in their plan would encourage them to participate — up from 52% in 2021

Financial wellness plays a strong role here. Forty-eight percent of non-participants said paying off debt would motivate them to enroll in the plan.

Financial wellness and plan design features can provide significant motivation to enroll.

Employees can use Lincoln WellnessPATH® to make a plan to pay off debt.

Explore LincolnFinancial.com/RetirementIncome to see how in-plan guaranteed income options can protect savings and create lifetime income. You’ll find an explanation of how guaranteed income works, how SECURE Act 2.0 provides a fiduciary safe harbor and more.

Find a solution to guaranteed retirement income using our simple selection tool.

For auto features, contact your Lincoln representative to adopt auto enroll and auto increase, if you haven’t already.

Read the full report to explore the 2023 research and solutions.

Wellness@Work is a platform for research and viewpoints on central issues related to group benefits and retirement planning. The program seeks to identify forward-thinking ways to help financial professionals, employers and employees. As part of the program, Lincoln sponsors both proprietary and third party research, with an emphasis on what drives better benefit and retirement outcomes.

The 2023 Wellness@Work study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Greenwald & Associates, a third party market research firm, conducted the study on behalf of Lincoln Retirement Plan Services. Greenwald & Associates is not associated with Lincoln Financial Group. Online interviewing took place from February 16 to March 14, 2023. Data is weighted by demographics to mirror the total population.

The 2022 Wellness@Work study is based on a national survey of 2,503 full-time workers who have access to insurance benefits (at least one of the following: disability, life, dental, vision, critical illness, accident or hospital indemnity) through their employer. Greenwald Research, a third-party market research firm, conducted the study on behalf of Lincoln Financial Group. Greenwald Research is not associated with Lincoln Financial Group. Online interviewing took place from January 28, 2022 to March 1, 2022. Data is weighted by demographics to mirror the total population.

How do we turn non-participants into participants? It may be easier than you think. Half of non-participants have contributed to a retirement plan in the past, including 17% who contributed to their current employer’s plan. In fact, 14% stopped contributing in the past year. These former savers may only need a small nudge to get back on track.

See what employees want to know about in-plan income and how you can answer their questions.

Non-participants told us how to encourage them to enroll, and the answers are clear. Auto enrollment, employer match, and in-plan income options are strong motivators.

62% of non-participants

would likely stay in the plan if their employer auto-enrolled everyone not currently contributing

77% of non-participants

would be likely to save in the plan if a 3% match were offered

72% of non-participants

say a guaranteed income option in their plan would encourage them to participate — up from 52% in 2021

Financial wellness plays a strong role here. Forty-eight percent of non-participants said paying off debt would motivate them to enroll in the plan.

Financial wellness and plan design features can provide significant motivation to enroll.

Employees can use Lincoln WellnessPATH® to make a plan to pay off debt.

Explore LincolnFinancial.com/RetirementIncome to see how in-plan guaranteed income options can protect savings and create lifetime income. You’ll find an explanation of how guaranteed income works, how SECURE Act 2.0 provides a fiduciary safe harbor and more.

Find a solution to guaranteed retirement income using our simple selection tool.

For auto features, contact your Lincoln representative to adopt auto enroll and auto increase, if you haven’t already.

Read the full report to explore the 2023 research and solutions.

Wellness@Work is a platform for research and viewpoints on central issues related to group benefits and retirement planning. The program seeks to identify forward-thinking ways to help financial professionals, employers and employees. As part of the program, Lincoln sponsors both proprietary and third party research, with an emphasis on what drives better benefit and retirement outcomes.

The 2023 Wellness@Work study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Greenwald & Associates, a third party market research firm, conducted the study on behalf of Lincoln Retirement Plan Services. Greenwald & Associates is not associated with Lincoln Financial Group. Online interviewing took place from February 16 to March 14, 2023. Data is weighted by demographics to mirror the total population.

The 2022 Wellness@Work study is based on a national survey of 2,503 full-time workers who have access to insurance benefits (at least one of the following: disability, life, dental, vision, critical illness, accident or hospital indemnity) through their employer. Greenwald Research, a third-party market research firm, conducted the study on behalf of Lincoln Financial Group. Greenwald Research is not associated with Lincoln Financial Group. Online interviewing took place from January 28, 2022 to March 1, 2022. Data is weighted by demographics to mirror the total population.

How do we turn non-participants into participants? It may be easier than you think. Half of non-participants have contributed to a retirement plan in the past, including 17% who contributed to their current employer’s plan. In fact, 14% stopped contributing in the past year. These former savers may only need a small nudge to get back on track.

See what employees want to know about in-plan income and how you can answer their questions.

Non-participants told us how to encourage them to enroll, and the answers are clear. Auto enrollment, employer match, and in-plan income options are strong motivators.

62% of non-participants

would likely stay in the plan if their employer auto-enrolled everyone not currently contributing

77% of non-participants

would be likely to save in the plan if a 3% match were offered

72% of non-participants

say a guaranteed income option in their plan would encourage them to participate — up from 52% in 2021

Financial wellness plays a strong role here. Forty-eight percent of non-participants said paying off debt would motivate them to enroll in the plan.

Financial wellness and plan design features can provide significant motivation to enroll.

Employees can use Lincoln WellnessPATH® to make a plan to pay off debt.

Explore LincolnFinancial.com/RetirementIncome to see how in-plan guaranteed income options can protect savings and create lifetime income. You’ll find an explanation of how guaranteed income works, how SECURE Act 2.0 provides a fiduciary safe harbor and more.

Find a solution to guaranteed retirement income using our simple selection tool.

For auto features, contact your Lincoln representative to adopt auto enroll and auto increase, if you haven’t already.

Read the full report to explore the 2023 research and solutions.

Wellness@Work is a platform for research and viewpoints on central issues related to group benefits and retirement planning. The program seeks to identify forward-thinking ways to help financial professionals, employers and employees. As part of the program, Lincoln sponsors both proprietary and third party research, with an emphasis on what drives better benefit and retirement outcomes.

The 2023 Wellness@Work study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Greenwald & Associates, a third party market research firm, conducted the study on behalf of Lincoln Retirement Plan Services. Greenwald & Associates is not associated with Lincoln Financial Group. Online interviewing took place from February 16 to March 14, 2023. Data is weighted by demographics to mirror the total population.

The 2022 Wellness@Work study is based on a national survey of 2,503 full-time workers who have access to insurance benefits (at least one of the following: disability, life, dental, vision, critical illness, accident or hospital indemnity) through their employer. Greenwald Research, a third-party market research firm, conducted the study on behalf of Lincoln Financial Group. Greenwald Research is not associated with Lincoln Financial Group. Online interviewing took place from January 28, 2022 to March 1, 2022. Data is weighted by demographics to mirror the total population.

How do we turn non-participants into participants? It may be easier than you think. Half of non-participants have contributed to a retirement plan in the past, including 17% who contributed to their current employer’s plan. In fact, 14% stopped contributing in the past year. These former savers may only need a small nudge to get back on track.

See what employees want to know about in-plan income and how you can answer their questions.

Non-participants told us how to encourage them to enroll, and the answers are clear. Auto enrollment, employer match, and in-plan income options are strong motivators.

62% of non-participants

would likely stay in the plan if their employer auto-enrolled everyone not currently contributing

77% of non-participants

would be likely to save in the plan if a 3% match were offered

72% of non-participants

say a guaranteed income option in their plan would encourage them to participate — up from 52% in 2021

Financial wellness plays a strong role here. Forty-eight percent of

non-participants said paying off debt would motivate them to enroll in the plan.

Financial wellness and plan design features can provide significant motivation to enroll.

Employees can use Lincoln WellnessPATH® to make a plan to pay off debt.

Explore LincolnFinancial.com/RetirementIncome to see how in-plan guaranteed income options can protect savings and create lifetime income. You’ll find an explanation of how guaranteed income works, how SECURE Act 2.0 provides a fiduciary safe harbor and more.

Find a solution to guaranteed retirement income using our simple selection tool.

For auto features, contact your Lincoln representative to adopt auto enroll and auto increase, if you haven’t already.

Read the full report to explore the 2023 research and solutions.

Wellness@Work is a platform for research and viewpoints on central issues related to group benefits and retirement planning. The program seeks to identify forward-thinking ways to help financial professionals, employers and employees. As part of the program, Lincoln sponsors both proprietary and third party research, with an emphasis on what drives better benefit and retirement outcomes.

The 2023 Wellness@Work study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Greenwald & Associates, a third party market research firm, conducted the study on behalf of Lincoln Retirement Plan Services. Greenwald & Associates is not associated with Lincoln Financial Group. Online interviewing took place from February 16 to March 14, 2023. Data is weighted by demographics to mirror the total population.

The 2022 Wellness@Work study is based on a national survey of 2,503 full-time workers who have access to insurance benefits (at least one of the following: disability, life, dental, vision, critical illness, accident or hospital indemnity) through their employer. Greenwald Research, a third-party market research firm, conducted the study on behalf of Lincoln Financial Group. Greenwald Research is not associated with Lincoln Financial Group. Online interviewing took place from January 28, 2022 to March 1, 2022. Data is weighted by demographics to mirror the total population.