Retirement Income

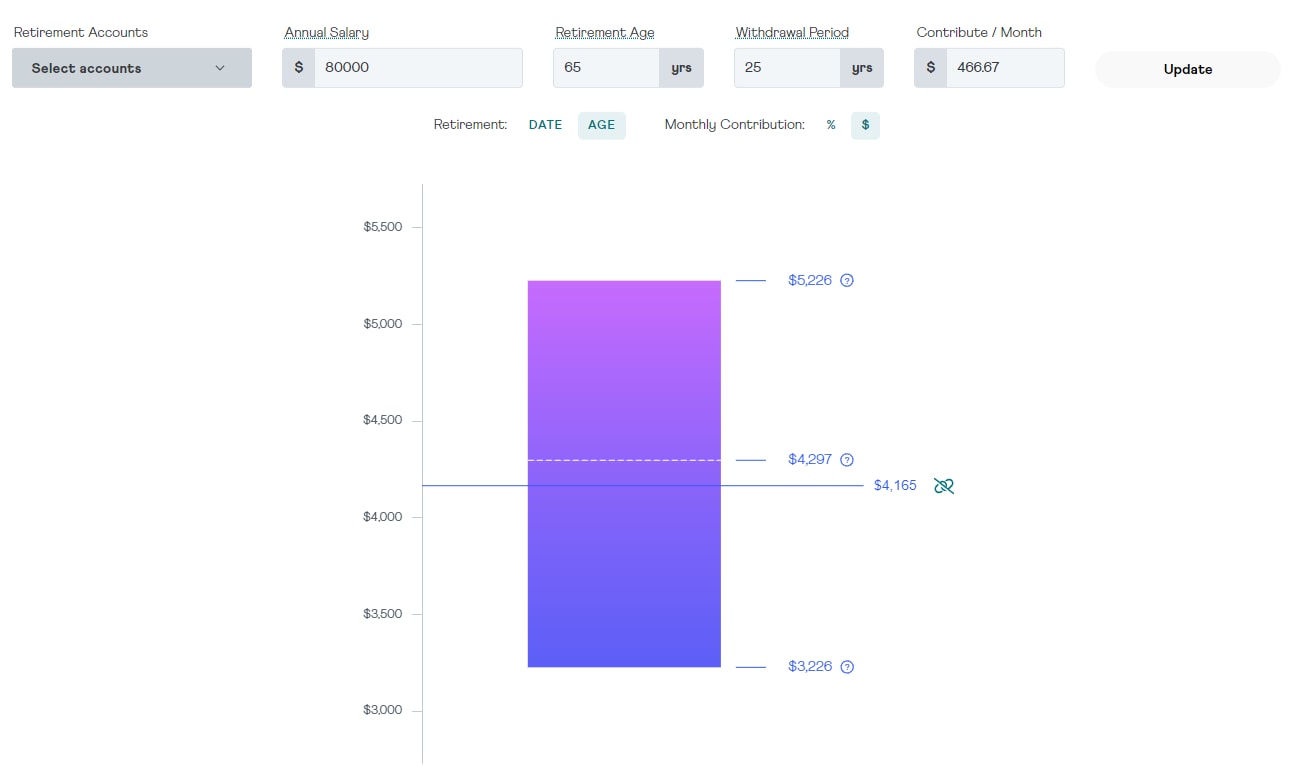

Retirement Income is the calculator in the wellness platform used to find expected retirement income, meaning the amount you will have per month after retirement. When you navigate to the Retirement Income tab, there are four assumptions taken into consideration.

The four assumptions in Retirement Income are:

- Annual Salary - your income

- Retirement Age - the age at which you wish to retire (can also select a date)

- Withdrawal Period - how long you expect to need to withdraw (life expectancy)

- Contribute / Month - what you are contributing per month to retirement (choose between a percentage or a dollar amount)

The tool will populate the assumptions automatically to begin with, based on numbers from your profile, but you can adjust each assumption. If you have not yet entered this information you will be prompted to do so.

Assumptions based on profile information. All of the inputs are editable.

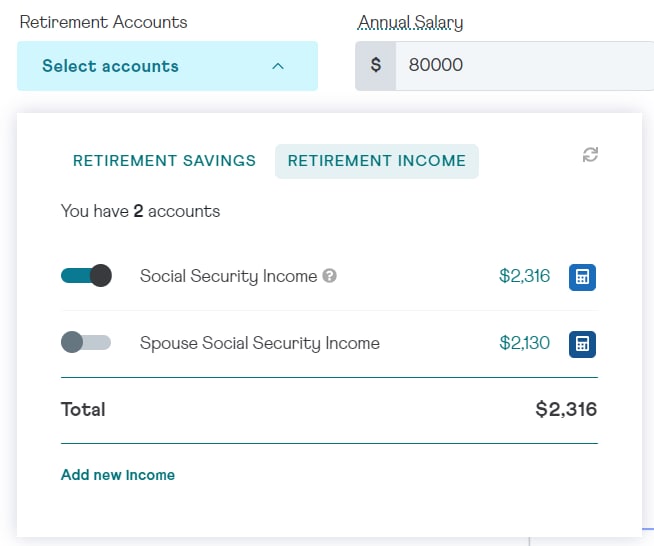

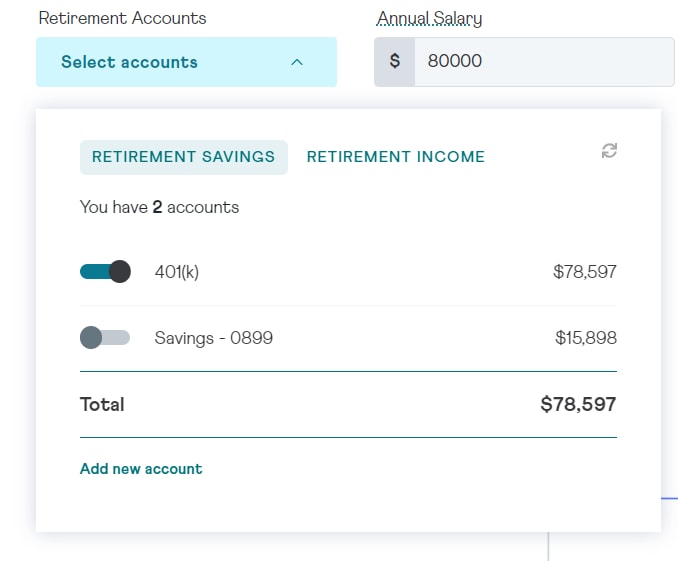

You can add retirement savings and income into this prediction by using the 'Select Accounts' drop down. Any savings you have aggregated will appear under 'Retirement Savings'. Social Security will show under 'Retirement Income' along with other income streams you know you will have in retirement. You can type in your social security amount if you know what it will be, or you can click the calculator icon to have the platform compute this value for you. If you are marked as ‘Married’ on your profile, you will have the option to add your spouse’s social security as well.

To add a new account or stream of income, click 'Add new account' at the bottom of either of these account lists.

In the graph below the assumptions, you will see a bar chart with a horizontal blue line. The blue line is your monthly income need. All projections are calculated based on monthly amounts. Your withdrawal need is adjustable by dragging the bar or by inputting numbers on the right side of it. The system defaults to a 70% replacement ratio, so 70% of your current monthly income is your (assumed) withdrawal need amount. You can adjust your income need by dragging the horizontal line up or down.

The link icon next to the horizontal line allows you to link the ‘monthly need’ amount to your current monthly budget amount on the My Money tab. If there is a slash through the link icon, it is using a value that is not aligned with your current monthly budget.

The retirement calculator uses the Monte Carlo simulation. This means that risk and other unknown variables are factored into the projections.

The top dotted line shows the upper 75th percentile for the distribution; 25% of the outcomes were larger than or equal to that amount. The middle dotted line is the median value of your estimated retirement income, while the bottom dotted line represents the 10th percentile of distribution, meaning 90% of projected outcomes are greater than this amount.

In our example:

- 25% are greater than or equal to ___ (will need to be updated based on image)

- The median value is ___ (will need to be updated based on image)

- 10% are less than or equal to ___ (will need to be updated based on image)

If you have questions related to the portfolio makeup assumptions, there is a link in the bottom of the page called "Key Assumptions and Material Limitations." Here you will get to see what it set defaults to, and other details about the calculator.