When it comes to long-term care, putting a plan in place for your clients and their loved ones can help them control their care and assets. Consider creating strategies by combining a Lincoln long-term care solution with a trust to protect against future long-term care expenses.

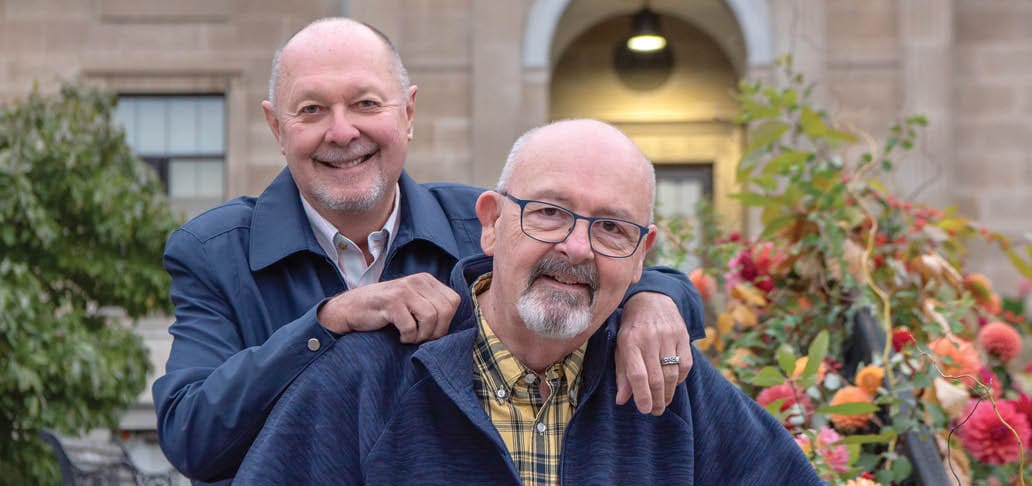

Joe and Dom recently sold their successful business and have benefited from favorable equity markets. They’ve just started building a long-term care plan and would like to take advantage of tax-efficiency while also maximizing the legacy they want to pass along to their children. Their goal is to obtain coverage that meets their lifestyle and would prefer to do their planning within an established spousal lifetime access trust.

Grantor Spouse

(e.g., husband)

SLAT

Trustee can make discretionary distributions

Beneficiary Spouse

Children

Second Death

Let’s talk about how this strategy could work. Joe could fund a spousal lifetime access trust. The trust would then purchase a Lincoln MoneyGuard® long-term care solution, or a Lincoln life insurance policy with an LTC rider on Dom, who would be the trust beneficiary. Since the LTC benefits don’t accrue to the grantor (Joe), there is no IRC 2036 includability.

In many SLATs, a reciprocal trust will be established where Spouse B is the grantor and Spouse A is the beneficiary plus the insured for the LTC benefits. In a case where spouses establish reciprocal trusts, a few of the trust terms must be different in the respective trusts. If the trust terms in the two trusts are exactly the same, the IRS can collapse the separate trusts into one, triggering the IRC 2036. Since each taxpayer’s situation is different, your client should discuss their specific details with their legal and tax professionals.

Ready to help clients protect their legacy with trust-owned life insurance?

Email us at TOLI@LFG.com or call us at 800-832-5372.

©2025 Lincoln National Corporation

For financial professional use only. Not for use with the public.

Any tax information contained in this communication, while presented in good faith, is general in nature and is not intended to be a rendering of legal, accounting or tax advice and should not be used without the advice and guidance of a professional Tax Advisor. Furthermore, the information contained herein may not be applicable or suitable to an individual’s specific circumstances or needs and may require consideration of other matters.

Important information

This material is intended for informational and educational purposes only. It is not intended to be investment, legal, or tax advice. Work with your financial, legal and tax professionals for guidance.

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Affiliates include broker-dealer/distributor Lincoln Financial Distributors, Inc., Radnor, PA, and insurance company affiliates The Lincoln National Life Insurance Company, Fort Wayne, IN, and Lincoln Life & Annuity Company of New York, Syracuse, NY.

Issuers:

The Lincoln National Life Insurance Company, Fort Wayne, IN

The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

All guarantees and benefits of the insurance policy are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer and/or insurance agency selling the policy, or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer. Products, riders and features are subject to state availability. The insurance policy and riders have limitations, exclusions, and/or reductions. Check state availability. Long-term care benefit riders may not cover all costs associated with long-term care costs incurred by the insured during the coverage period.

Lincoln variable universal life insurance is sold by prospectus. Carefully consider the investment objectives, risks, and charges and expenses of the policy and its underlying investment options. This and other important information can be found in the prospectus for the variable universal life policy and the prospectuses for the underlying investment options. Prospectuses are available upon request and should be read carefully before investing or sending money. For current prospectuses, please call 800-444-2363 or go to www.LincolnFinancial.com.

Distributor: Lincoln Financial Distributors, Inc., a broker-dealer

Policies:

MoneyGuard Market Advantage® (2024) is issued by The Lincoln National Life Insurance Company, Fort Wayne, IN on Policy Form ICC20-MGV892/20-MGV892 with a Long-Term Care Benefits Rider (LTCBR) on Rider Form ICC24LTCBR-898/LTCBR-898, a Value Protection Rider on Form ICC20VPR-892/VPR-892 and a Benefit Transfer Rider on Form ICC22BTR-895/BTR-895. Available in all states except CA and NY.

MoneyGuard Fixed Advantage® is a universal life insurance policy with a long-term care benefits rider issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, on Policy Form ICC19-MG890/19-MG890 with the following riders: Value Protection Endorsement (VPE) on form ICC19END-10534/END-10534; Terminal Illness Acceleration of Death Benefit Rider (TIR) on form ICC19TIR-891/TIR-891; Long-Term Care Benefits Rider (LTCBR) on form ICC19LTCBR-890/LTCBR-890; Benefit Transfer Rider on form ICC21BTR-894/BTR-894. Available in all states except CA and NY.

Lincoln MoneyGuard® II, universal life insurance policy form LN880/ICC13LN880 with the Value Protection Rider (VPR) on form LR880 and state variations/ICC15LR880 Rev, Long-Term Care Acceleration of Benefits Rider (LABR) on form LR881/ICC13LR881, and optional Long-Term Care Extension of Benefits Rider (LEBR) on form LR882/ICC13LR882. Only available in CA.

Only appropriately-licensed Registered Representatives can sell variable products.

LCN-7887162-042225

10/25 Z10

Order code: LIF-TOLID-IDE001

When it comes to long-term care, putting a plan in place for your clients and their loved ones can help them control their care and assets. Consider creating strategies by combining a Lincoln long-term care solution with a trust to protect against future long-term care expenses.

Joe and Dom recently sold their successful business and have benefited from favorable equity markets. They’ve just started building a long-term care plan and would like to take advantage of tax-efficiency while also maximizing the legacy they want to pass along to their children. Their goal is to obtain coverage that meets their lifestyle and would prefer to do their planning within an established spousal lifetime access trust.

Grantor Spouse

(e.g., husband)

SLAT

Trustee can make discretionary distributions

Beneficiary Spouse

Second Death

Children

Let’s talk about how this strategy could work. Joe could fund a spousal lifetime access trust. The trust would then purchase a Lincoln MoneyGuard® long-term care solution, or a Lincoln life insurance policy with an LTC rider on Dom, who would be the trust beneficiary. Since the LTC benefits don’t accrue to the grantor (Joe), there is no IRC 2036 includability.

In many SLATs, a reciprocal trust will be established where Spouse B is the grantor and Spouse A is the beneficiary plus the insured for the LTC benefits. In a case where spouses establish reciprocal trusts, a few of the trust terms must be different in the respective trusts. If the trust terms in the two trusts are exactly the same, the IRS can collapse the separate trusts into one, triggering the IRC 2036. Since each taxpayer’s situation is different, your client should discuss their specific details with their legal and tax professionals.

Ready to help clients protect their legacy with trust-owned life insurance? Email us at TOLI@LFG.com or call us at 800-832-5372.

©2025 Lincoln National Corporation

Any tax information contained in this communication, while presented in good faith, is general in nature and is not intended to be a rendering of legal, accounting or tax advice and should not be used without the advice and guidance of a professional Tax Advisor. Furthermore, the information contained herein may not be applicable or suitable to an individual’s specific circumstances or needs and may require consideration of other matters.

Important information

This material is intended for informational and educational purposes only. It is not intended to be investment, legal, or tax advice. Work with your financial, legal and tax professionals for guidance.

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Affiliates include broker-dealer/distributor Lincoln Financial Distributors, Inc., Radnor, PA, and insurance company affiliates The Lincoln National Life Insurance Company, Fort Wayne, IN, and Lincoln Life & Annuity Company of New York, Syracuse, NY.

Issuers:

The Lincoln National Life Insurance Company, Fort Wayne, IN

The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

All guarantees and benefits of the insurance policy are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer and/or insurance agency selling the policy, or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer. Products, riders and features are subject to state availability. The insurance policy and riders have limitations, exclusions, and/or reductions. Check state availability. Long-term care benefit riders may not cover all costs associated with long-term care costs incurred by the insured during the coverage period.

Lincoln variable universal life insurance is sold by prospectus. Carefully consider the investment objectives, risks, and charges and expenses of the policy and its underlying investment options. This and other important information can be found in the prospectus for the variable universal life policy and the prospectuses for the underlying investment options. Prospectuses are available upon request and should be read carefully before investing or sending money. For current prospectuses, please call 800-444-2363 or go to www.LincolnFinancial.com.

Distributor: Lincoln Financial Distributors, Inc., a broker-dealer

Policies:

MoneyGuard Market Advantage® (2024) is issued by The Lincoln National Life Insurance Company, Fort Wayne, IN on Policy Form ICC20-MGV892/20-MGV892 with a Long-Term Care Benefits Rider (LTCBR) on Rider Form ICC24LTCBR-898/LTCBR-898, a Value Protection Rider on Form ICC20VPR-892/VPR-892 and a Benefit Transfer Rider on Form ICC22BTR-895/BTR-895. Available in all states except CA and NY.

MoneyGuard Fixed Advantage® is a universal life insurance policy with a long-term care benefits rider issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, on Policy Form ICC19-MG890/19-MG890 with the following riders: Value Protection Endorsement (VPE) on form ICC19END-10534/END-10534; Terminal Illness Acceleration of Death Benefit Rider (TIR) on form ICC19TIR-891/TIR-891; Long-Term Care Benefits Rider (LTCBR) on form ICC19LTCBR-890/LTCBR-890; Benefit Transfer Rider on form ICC21BTR-894/BTR-894. Available in all states except CA and NY.

Lincoln MoneyGuard® II, universal life insurance policy form LN880/ICC13LN880 with the Value Protection Rider (VPR) on form LR880 and state variations/ICC15LR880 Rev, Long-Term Care Acceleration of Benefits Rider (LABR) on form LR881/ICC13LR881, and optional Long-Term Care Extension of Benefits Rider (LEBR) on form LR882/ICC13LR882. Only available in CA.

Only appropriately-licensed Registered Representatives can sell variable products.

For financial professional use only. Not for use with the public.

LCN-7887162-042225

10/25 Z10

Order code: LIF-TOLID-IDE001

When it comes to long-term care, putting a plan in place for your clients and their loved ones can help them control their care and assets. Consider creating strategies by combining a Lincoln long-term care solution with a trust to protect against future long-term care expenses.

Joe and Dom recently sold their successful business and have benefited from favorable equity markets. They’ve just started building a long-term care plan and would like to take advantage of tax-efficiency while also maximizing the legacy they want to pass along to their children. Their goal is to obtain coverage that meets their lifestyle and would prefer to do their planning within an established spousal lifetime access trust.

Grantor Spouse

(e.g., husband)

SLAT

Trustee can make discretionary distributions

Beneficiary Spouse

Second Death

Children

Let’s talk about how this strategy could work. Joe could fund a spousal lifetime access trust. The trust would then purchase a Lincoln MoneyGuard® long-term care solution, or a Lincoln life insurance policy with an LTC rider on Dom, who would be the trust beneficiary. Since the LTC benefits don’t accrue to the grantor (Joe), there is no IRC 2036 includability.

In many SLATs, a reciprocal trust will be established where Spouse B is the grantor and Spouse A is the beneficiary plus the insured for the LTC benefits. In a case where spouses establish reciprocal trusts, a few of the trust terms must be different in the respective trusts. If the trust terms in the two trusts are exactly the same, the IRS can collapse the separate trusts into one, triggering the IRC 2036. Since each taxpayer’s situation is different, your client should discuss their specific details with their legal and tax professionals.

Ready to help clients protect their legacy with trust-owned life insurance? Email us at TOLI@LFG.com or call us at 800-832-5372.

Any tax information contained in this communication, while presented in good faith, is general in nature and is not intended to be a rendering of legal, accounting or tax advice and should not be used without the advice and guidance of a professional Tax Advisor. Furthermore, the information contained herein may not be applicable or suitable to an individual’s specific circumstances or needs and may require consideration of other matters.

Important information

This material is intended for informational and educational purposes only. It is not intended to be investment, legal, or tax advice. Work with your financial, legal and tax professionals for guidance.

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Affiliates include broker-dealer/distributor Lincoln Financial Distributors, Inc., Radnor, PA, and insurance company affiliates The Lincoln National Life Insurance Company, Fort Wayne, IN, and Lincoln Life & Annuity Company of New York, Syracuse, NY.

Issuers:

The Lincoln National Life Insurance Company, Fort Wayne, IN

The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

All guarantees and benefits of the insurance policy are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer and/or insurance agency selling the policy, or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer. Products, riders and features are subject to state availability. The insurance policy and riders have limitations, exclusions, and/or reductions. Check state availability. Long-term care benefit riders may not cover all costs associated with long-term care costs incurred by the insured during the coverage period.

Lincoln variable universal life insurance is sold by prospectus. Carefully consider the investment objectives, risks, and charges and expenses of the policy and its underlying investment options. This and other important information can be found in the prospectus for the variable universal life policy and the prospectuses for the underlying investment options. Prospectuses are available upon request and should be read carefully before investing or sending money. For current prospectuses, please call 800-444-2363 or go to www.LincolnFinancial.com.

Distributor: Lincoln Financial Distributors, Inc., a broker-dealer

Policies:

MoneyGuard Market Advantage® (2024) is issued by The Lincoln National Life Insurance Company, Fort Wayne, IN on Policy Form ICC20-MGV892/20-MGV892 with a Long-Term Care Benefits Rider (LTCBR) on Rider Form ICC24LTCBR-898/LTCBR-898, a Value Protection Rider on Form ICC20VPR-892/VPR-892 and a Benefit Transfer Rider on Form ICC22BTR-895/BTR-895. Available in all states except CA and NY.

MoneyGuard Fixed Advantage® is a universal life insurance policy with a long-term care benefits rider issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, on Policy Form ICC19-MG890/19-MG890 with the following riders: Value Protection Endorsement (VPE) on form ICC19END-10534/END-10534; Terminal Illness Acceleration of Death Benefit Rider (TIR) on form ICC19TIR-891/TIR-891; Long-Term Care Benefits Rider (LTCBR) on form ICC19LTCBR-890/LTCBR-890; Benefit Transfer Rider on form ICC21BTR-894/BTR-894. Available in all states except CA and NY.

Lincoln MoneyGuard® II, universal life insurance policy form LN880/ICC13LN880 with the Value Protection Rider (VPR) on form LR880 and state variations/ICC15LR880 Rev, Long-Term Care Acceleration of Benefits Rider (LABR) on form LR881/ICC13LR881, and optional Long-Term Care Extension of Benefits Rider (LEBR) on form LR882/ICC13LR882. Only available in CA.

Only appropriately-licensed Registered Representatives can sell variable products.

For financial professional use only. Not for use with the public.

©2025 Lincoln National Corporation

LCN-7887162-042225

10/25 Z10

Order code: LIF-TOLID-IDE001

When it comes to long-term care, putting a plan in place for your clients and their loved ones can help them control their care and assets. Consider creating strategies by combining a Lincoln long-term care solution with a trust to protect against future long-term care expenses.

Joe and Dom recently sold their successful business and have benefited from favorable equity markets. They’ve just started building a long-term care plan and would like to take advantage of tax-efficiency while also maximizing the legacy they want to pass along to their children. Their goal is to obtain coverage that meets their lifestyle and would prefer to do their planning within an established spousal lifetime access trust.

Grantor Spouse

(e.g., husband)

SLAT

Trustee can make discretionary distributions

Beneficiary Spouse

Children

Second Death

Let’s talk about how this strategy could work. Joe could fund a spousal lifetime access trust. The trust would then purchase a Lincoln MoneyGuard® long-term care solution, or a Lincoln life insurance policy with an LTC rider on Dom, who would be the trust beneficiary. Since the LTC benefits don’t accrue to the grantor (Joe), there is no IRC 2036 includability.

In many SLATs, a reciprocal trust will be established where Spouse B is the grantor and Spouse A is the beneficiary plus the insured for the LTC benefits. In a case where spouses establish reciprocal trusts, a few of the trust terms must be different in the respective trusts. If the trust terms in the two trusts are exactly the same, the IRS can collapse the separate trusts into one, triggering the IRC 2036. Since each taxpayer’s situation is different, your client should discuss their specific details with their legal and tax professionals.

Ready to help clients protect their legacy with trust-owned life insurance?

Email us at TOLI@LFG.com or call us at 800-832-5372.

©2025 Lincoln National Corporation

For financial professional use only. Not for use with the public.

Any tax information contained in this communication, while presented in good faith, is general in nature and is not intended to be a rendering of legal, accounting or tax advice and should not be used without the advice and guidance of a professional Tax Advisor. Furthermore, the information contained herein may not be applicable or suitable to an individual’s specific circumstances or needs and may require consideration of other matters.

Important information

This material is intended for informational and educational purposes only. It is not intended to be investment, legal, or tax advice. Work with your financial, legal and tax professionals for guidance.

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Affiliates include broker-dealer/distributor Lincoln Financial Distributors, Inc., Radnor, PA, and insurance company affiliates The Lincoln National Life Insurance Company, Fort Wayne, IN, and Lincoln Life & Annuity Company of New York, Syracuse, NY.

Issuers:

The Lincoln National Life Insurance Company, Fort Wayne, IN

The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

All guarantees and benefits of the insurance policy are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer and/or insurance agency selling the policy, or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer. Products, riders and features are subject to state availability. The insurance policy and riders have limitations, exclusions, and/or reductions. Check state availability. Long-term care benefit riders may not cover all costs associated with long-term care costs incurred by the insured during the coverage period.

Lincoln variable universal life insurance is sold by prospectus. Carefully consider the investment objectives, risks, and charges and expenses of the policy and its underlying investment options. This and other important information can be found in the prospectus for the variable universal life policy and the prospectuses for the underlying investment options. Prospectuses are available upon request and should be read carefully before investing or sending money. For current prospectuses, please call 800-444-2363 or go to www.LincolnFinancial.com.

Distributor: Lincoln Financial Distributors, Inc., a broker-dealer

Policies:

MoneyGuard Market Advantage® (2024) is issued by The Lincoln National Life Insurance Company, Fort Wayne, IN on Policy Form ICC20-MGV892/20-MGV892 with a Long-Term Care Benefits Rider (LTCBR) on Rider Form ICC24LTCBR-898/LTCBR-898, a Value Protection Rider on Form ICC20VPR-892/VPR-892 and a Benefit Transfer Rider on Form ICC22BTR-895/BTR-895. Available in all states except CA and NY.

MoneyGuard Fixed Advantage® is a universal life insurance policy with a long-term care benefits rider issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, on Policy Form ICC19-MG890/19-MG890 with the following riders: Value Protection Endorsement (VPE) on form ICC19END-10534/END-10534; Terminal Illness Acceleration of Death Benefit Rider (TIR) on form ICC19TIR-891/TIR-891; Long-Term Care Benefits Rider (LTCBR) on form ICC19LTCBR-890/LTCBR-890; Benefit Transfer Rider on form ICC21BTR-894/BTR-894. Available in all states except CA and NY.

Lincoln MoneyGuard® II, universal life insurance policy form LN880/ICC13LN880 with the Value Protection Rider (VPR) on form LR880 and state variations/ICC15LR880 Rev, Long-Term Care Acceleration of Benefits Rider (LABR) on form LR881/ICC13LR881, and optional Long-Term Care Extension of Benefits Rider (LEBR) on form LR882/ICC13LR882. Only available in CA.

Only appropriately-licensed Registered Representatives can sell variable products.

LCN-7887162-042225

10/25 Z10

Order code: LIF-TOLID-IDE001