1i4LIFE® Advantage is available for an additional charge of 0.40% (single and joint life) above standard contract expenses. There is a credit to clients who select a minimum Access Period of the greater of 20 years or until age 85 — with a $500,000 deposit the credit is 0.10% annually and with a $1,000,000 deposit the credit is 0.20% annually (see prospectus for complete details).

2For a defined time based on the Access Period chosen. The maximum Access Period for qualified contracts is to age 100 (115 for nonqualified money). The longer the Access Period, the lower the income payments. You may extend the length of the Access Period before the Lifetime Income Period begins, which will decrease subsequent i4LIFE® payments.

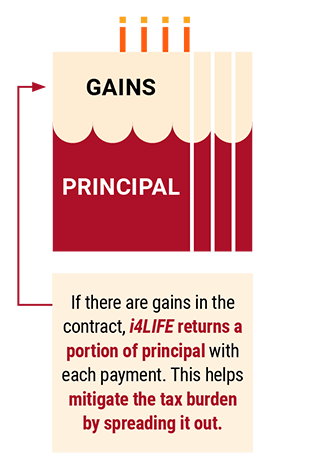

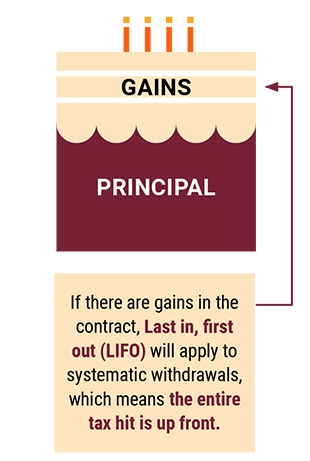

3The exclusion ratio only applies until the principal has been returned, and then the payments are fully taxable.

Important information:

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Variable annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal. Variable annuities contain both investment and insurance components and have fees and charges, including mortality and expense, administrative, and advisory fees. Optional features are available for an additional charge. The annuity’s value fluctuates with the market value of the underlying investment options, and all assets accumulate tax-deferred. Withdrawals of earnings are taxable as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax. Withdrawals will reduce the death benefit and cash surrender value.

Investors are advised to consider the investment objectives, risks, and charges and expenses of the variable annuity and its underlying investment options carefully before investing. The applicable prospectuses for the variable annuity and its underlying investment options contain this and other important information. Please call 877-533-5630 for free prospectuses. Read them carefully before investing or sending money. Products and features are subject to state availability.

Lincoln variable annuities (contract forms 30070-A 8/03, 30070-B, and state variations) are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln products are not a deposit nor FDIC-insured, may go down in value, and are not insured by any federal government agency or guaranteed by any bank or savings association. All guarantees and benefits of the insurance policy are subject to the claims-paying ability of the issuing insurance company. They are not backed by any entities other than the issuing company affiliates, and none makes any representation or guarantees regarding the claims-paying ability of the issuer.

Contracts sold in New York (contract forms 30070-A-NY and 30070-B-NY) are issued by Lincoln Life & Annuity Company of New York, Syracuse, NY, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer.

All contract and rider guarantees, including those for optional benefits, fixed subaccount crediting rates, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased, or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.