Harness the power of tax-advantaged income

Helping your clients minimize the impact of taxes on distributions is just as important as helping them accumulate wealth. With Lincoln RIA Class annuities, you have access to an innovative, tax-smart solution. You won’t find it anywhere but here.

Income with flexibility, control and tax advantages

i4LIFE® AdvantageAdvisor case study: Minimize taxes to maximize income

Retiring clients turn to you for help converting their retirement savings into a stream of tax-smart income that will last the rest of their lives.

Victor's challenge

Victor wants to do more than provide cash flow for his retiring clients. He wants an efficient solution that minimizes the impact of taxes on their retirement income while keeping them in control of their investment.

The solution

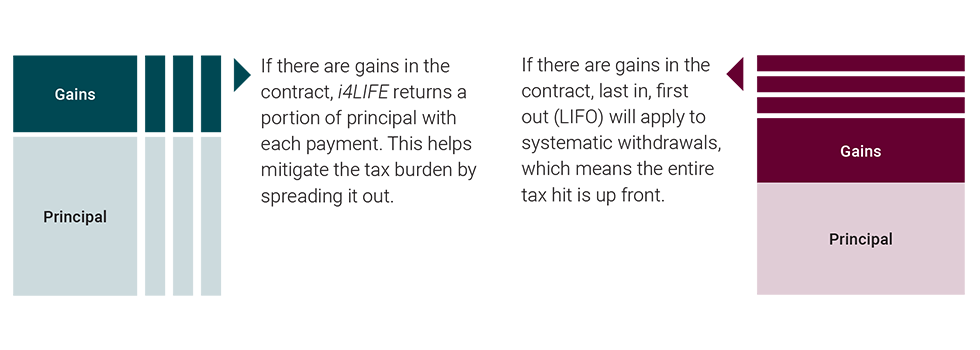

Victor sets his clients up with a source of lifetime income using a Lincoln RIA Class variable annuity with i4LIFE® Advantage because of the beneficial tax exclusion treatment it provides. Compare the tax treatment for i4LIFE payments to systematic withdrawals.

Get started

Connect with us and let your dedicated consultant make it easy for you to implement Lincoln RIA Class annuities.

Annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal.

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Investors are advised to consider the investment objectives, risks, and charges and expenses of the variable annuity and its underlying investment options carefully before investing. The applicable prospectuses for the variable annuity and its underlying investment options contain this and other important information. Please call 877-533-5630 for free prospectuses. Read them carefully before investing or sending money. Products and features are subject to state availability.

Lincoln products are not a deposit nor FDIC-insured, may go down in value, and are not insured by a federal government agency or guaranteed by any bank or savings association. All guarantees and benefits of the insurance policy are subject to the claims-paying ability of the issuing insurance company. They are not backed by any entity other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.