Our wellness resources give employees the tools and confidence to make smarter decisions in every aspect of their lives so they can focus on larger goals such as retirement.

Wellness solutions can help relieve employee stress — making a happier, more productive workforce — as well as help attract and retain top talent.

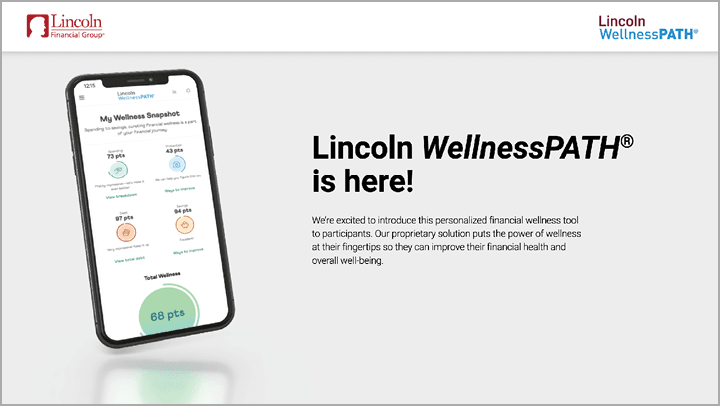

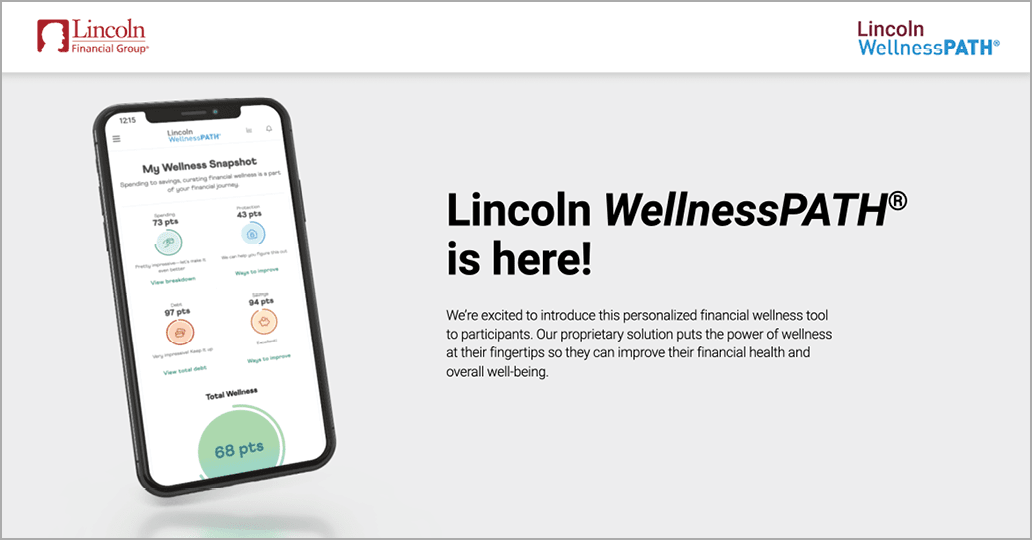

Our proprietary, personalized online tool gives employees custom action steps and resources to help them budget, set and track goals, aggregate their account information for a complete financial picture, and improve their financial wellness.

Lincoln offers online self-service education on simple financial wellness topics and long-term planning goals for every stage of life, as well as financial planning calculators, at LincolnFinancial.com.

RCs (where offered) deliver holistic wellness education and support in one-on-one or group meetings — in person, over the phone, or via video.

WellnessPATH Marketplace provides access to both proprietary and third party financial wellness solutions that can help employees improve their financial and overall well-being, including:

Making benefits more beneficial

Employers can opt to enhance certain solutions as part of their comprehensive benefits package. For example, an employer may choose to make payments directly to employee student loans or emergency savings, or they could offer matching retirement plan contributions based on student loan payments.

1 Products may not be available yet. Employees may be notified once they become available.

Contact your Lincoln Financial representative to learn how we can work together to help meet your specific needs.

Lincoln Financial® (“Lincoln”) is the marketing name for Lincoln National Corporation and its affiliates, including Lincoln Retirement Services Company, LLC, The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Affiliates are separately responsible for their own financial and contractual obligations.

Privacy | Legal | ©2025 Lincoln National Corporation

LCN-7646204-021825

3/25 Z15

Order code: DC-VALUE-IDE001

Our wellness resources give employees the tools and confidence to make smarter decisions in every aspect of their lives so they can focus on larger goals such as retirement.

Wellness solutions can help relieve employee stress — making a happier, more productive workforce — as well as help attract and retain top talent.

Our proprietary, personalized online tool gives employees custom action steps and resources to help them budget, set and track goals, aggregate their account information for a complete financial picture, and improve their financial wellness.

Lincoln offers online self-service education on simple financial wellness topics and long-term planning goals for every stage of life, as well as financial planning calculators, at LincolnFinancial.com.

RCs (where offered) deliver holistic wellness education and support in one-on-one or group meetings — in person, over the phone, or via video.

WellnessPATH Marketplace provides access to both proprietary and third party financial wellness solutions that can help employees improve their financial and overall well-being, including:

Making benefits more beneficial

Employers can opt to enhance certain solutions as part of their comprehensive benefits package. For example, an employer may choose to make payments directly to employee student loans or emergency savings, or they could offer matching retirement plan contributions based on student loan payments.

1 Products may not be available yet. Employees may be notified once they become available.

Contact your Lincoln Financial representative to learn how we can work together to help meet your specific needs.

Lincoln Financial® (“Lincoln”) is the marketing name for Lincoln National Corporation and its affiliates, including Lincoln Retirement Services Company, LLC, The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Affiliates are separately responsible for their own financial and contractual obligations.

Privacy | Legal | ©2025 Lincoln National Corporation

LCN-7646204-021825

3/25 Z15

Order code: DC-VALUE-IDE001

Our wellness resources give employees the tools and confidence to make smarter decisions in every aspect of their lives so they can focus on larger goals such

as retirement.

Wellness solutions can help relieve employee stress — making a happier, more productive workforce — as well as help attract and retain top talent.

Our proprietary, personalized online tool gives employees custom action steps and resources to help them budget, set and track goals, aggregate their account information for a complete financial picture, and improve their financial wellness.

WellnessPATH Marketplace provides access to both proprietary and third party financial wellness solutions that can help employees improve their financial and overall well-being, including:

Making benefits more beneficial

Employers can opt to enhance certain solutions as part of their comprehensive benefits package. For example, an employer may choose to make payments directly to employee student loans or emergency savings, or they could offer matching retirement plan contributions based on student loan payments.

Lincoln offers online self-service education on simple financial wellness topics and long-term planning goals for every stage of life, as well as financial planning calculators, at LincolnFinancial.com.

RCs (where offered) deliver holistic wellness education and support in one-on-one or group meetings — in person, over the phone, or via video.

1 Products may not be available yet. Employees may be notified once they become available.

Contact your Lincoln Financial representative to learn how we can work together to help meet your specific needs.

Lincoln Financial® (“Lincoln”) is the marketing name for Lincoln National Corporation and its affiliates, including Lincoln Retirement Services Company, LLC, The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Affiliates are separately responsible for their own financial and contractual obligations.

©2025 Lincoln National Corporation

LCN-7646204-021825

3/25 Z15

Order code: DC-VALUE-IDE001

Our wellness resources give employees the tools and confidence to make smarter decisions in every aspect of their lives so they can focus on larger goals such as retirement.

Wellness solutions can help relieve employee stress — making a happier, more productive workforce — as well as help attract and retain top talent.

Our proprietary, personalized online tool gives employees custom action steps and resources to help them budget, set and track goals, aggregate their account information for a complete financial picture, and improve their financial wellness.

Lincoln offers online self-service education on simple financial wellness topics and long-term planning goals for every stage of life, as well as financial planning calculators, at LincolnFinancial.com.

RCs (where offered) deliver holistic wellness education and support in one-on-one or group meetings — in person, over the phone, or via video.

WellnessPATH Marketplace provides access to both proprietary and third party financial wellness solutions that can help employees improve their financial and overall well-being, including:

Making benefits more beneficial

Employers can opt to enhance certain solutions as part of their comprehensive benefits package. For example, an employer may choose to make payments directly to employee student loans or emergency savings, or they could offer matching retirement plan contributions based on student loan payments.

1 Products may not be available yet. Employees may be notified once they become available.

Contact your Lincoln Financial representative to learn how we can work together to help meet your specific needs.

Lincoln Financial® (“Lincoln”) is the marketing name for Lincoln National Corporation and its affiliates, including Lincoln Retirement Services Company, LLC, The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Affiliates are separately responsible for their own financial and contractual obligations.

Privacy | Legal | ©2025 Lincoln National Corporation

LCN-7646204-021825

3/25 Z15

Order code: DC-VALUE-IDE001