- Select Core with Estate Lock

- Secure Core with Estate Lock

Lincoln ProtectedPay Select Core® with Estate LockSM

Meet Marian

“I need retirement income, but I want to protect the money I plan to leave my children.”

She chooses this option because she wants:

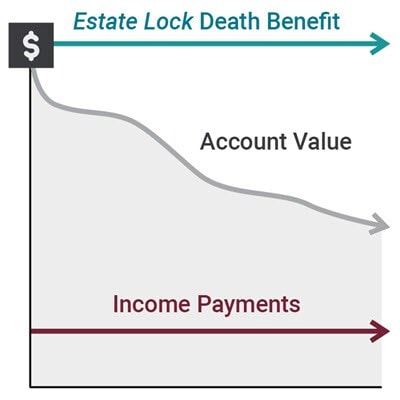

- Predictable income payments that will never decrease

- The ability to give the entire investment amount to loved ones

- Access to a broad set of investment choices

| Age | Single |

|---|---|

|

80+ |

6.35% |

|

75-79 |

6.20% |

|

70-74 |

5.95% |

|

65-69 |

5.85% |

|

59-64 |

4.25% |

Annual income rates are for Lincoln ProtectedPay Select Core® with the Estate LockSM Death Benefit. Annual income rates for the Select Core® option with the Guarantee of Principal Death Benefit are here.

Lincoln ProtectedPay Secure Core® and Estate LockSM

Meet Eric

“How can I secure lifetime income while also protecting the funds I hope to leave my wife.”

He chooses this option because she wants:

- Predictable income payments that will never decrease

- The ability to give the entire investment amount to loved ones

- Access to more focused, less risky set of investment choices

| Age | Single |

|---|---|

|

80+ |

6.55% |

|

75-79 |

6.45% |

|

70-74 |

6.25% |

|

65-69 |

6.00% |

|

59-64 |

4.50% |

Annual income rates are for Lincoln ProtectedPay Secure Core® with the Estate LockSM Death Benefit. Annual income rates for the Secure Core® option with the Guarantee of Principal Death Benefit are here.

How RIAs are helping clients allocate less to get more upfront income

View other Lincoln InvestmentSolutionsSM products

Get started

Connect with us and let your dedicated consultant make it easy for you to implement Lincoln RIA Class annuities.

1 Lincoln ProtectedPay® Core lifetime income options are available for an additional annual charge of 1.50% above standard contract expenses (maximum annual charge is 2.75%). Estate Lock℠ is available for an additional annual charge of 0.45% (maximum annual charge is 1.60%). The minimum issue age is 35, the maximum issue age is 75, and it is available for single life contracts only. Estate LockSM must be purchased at contract issue with Lincoln ProtectedPay® Core lifetime income options.

2 The 6% simple annual growth will continue for the earlier of 10 years or through age 85. The 6% enhancement is not available in any year a withdrawal is taken. Annual account value lock ins are available through age 85.

3 Excess withdrawals reduce Estate LockSM in the same proportion as the account value, but the benefit does not decline due to conforming or automatic required minimum distribution (RMD) withdrawals. Benefit terminates if account value reaches $0, but lifetime income would continue.

Lincoln ProtectedPay® lifetime income suite is available for an additional annual charge of 1.50% above standard contract expenses, or 1.60% for joint life (maximum annual charge is 2.75%). Investment requirements apply.

The 6% simple annual growth will continue for the earlier of 10 years or through age 85 (based on the oldest life for joint). The 6% enhancement is not available in any year a withdrawal is taken. See the prospectus for complete details.

The Protected Annual Income rate is based on the age at the time of the first withdrawal. Thereafter, the PAI rate will only change after reaching a higher age band and after an account value lock in. With Lincoln’s tiered income options; Lincoln ProtectedPay Select Plus®, Lincoln ProtectedPay Select Max®, Lincoln ProtectedPay Secure Plus®, and Lincoln ProtectedPay Secure Max®, your protected income payout will decrease if your account value falls to zero.

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Please consult your own independent advisor as to any tax, accounting or legal statements made herein.

Variable annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal. Variable annuities contain both investment and insurance components and have fees and charges, including mortality and expense, administrative, and advisory fees. Optional features are available for an additional charge. The annuity's value fluctuates with the market value of the underlying investment options, and all assets accumulate tax-deferred. Withdrawals of earnings are taxable as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax. Withdrawals will reduce the death benefit and cash surrender value.

Investors are advised to consider the investment objectives, risks and charges and expenses of the variable annuity and its underlying investment options carefully before investing. The applicable variable annuity prospectus contains this and other important information about the variable annuity and its underlying investment options. Please call 877-533-5630 for a free prospectus. Read it carefully before investing or sending money.

Products and features are subject to state availability.

Lincoln variable annuities and American Legacy® variable annuities are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

All contract and rider guarantees, including those for optional benefits, fixed subaccount crediting rates or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by any entity other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

Not available in New York.