Goals

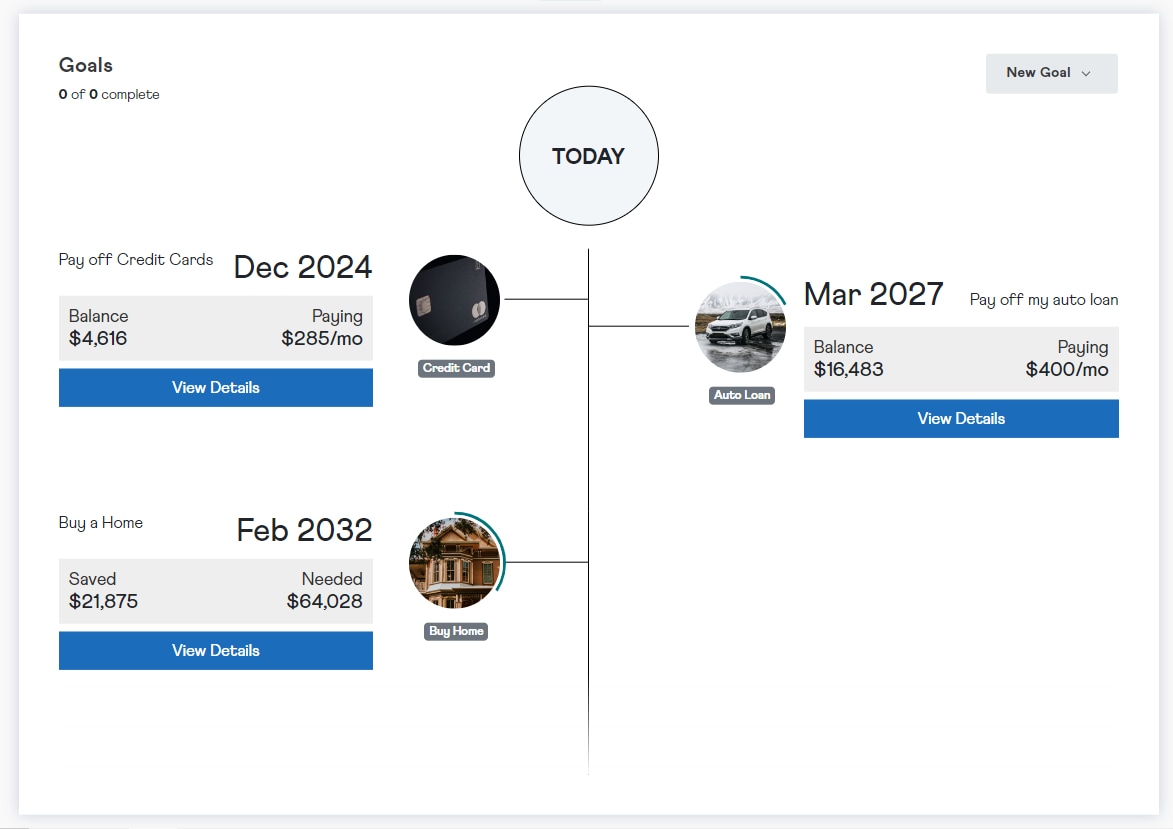

The Goals tab allows you to set and track financial goals. The tool will automatically track your progress towards your goals and project your completion date.

- Create a Goal

- How are goals calculated?

The Goals feature allows you to add specific financial goals that can be linked with your aggregated bank accounts to automatically update and provide real-time tracking of your goals.

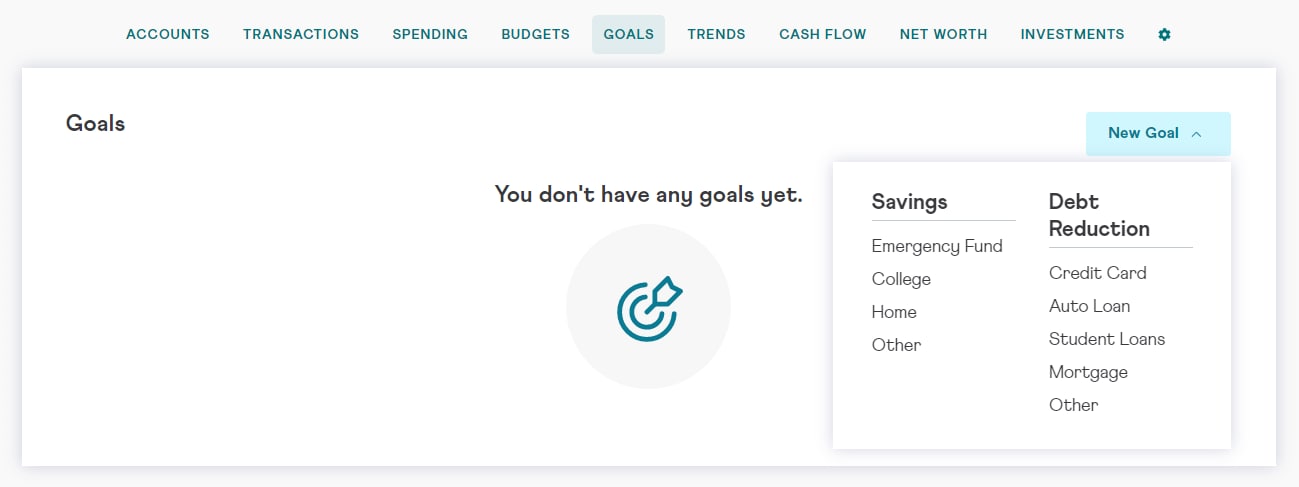

To create a new Goal, first click on 'New Goal' and select the type of goal you would like to create from the drop-down menu. If you do not see your specific goal type, click on 'Other' under either Savings or Debt Reduction, whichever fits your goal.

Once you have selected your goal type, you can update the goal name and add an image.

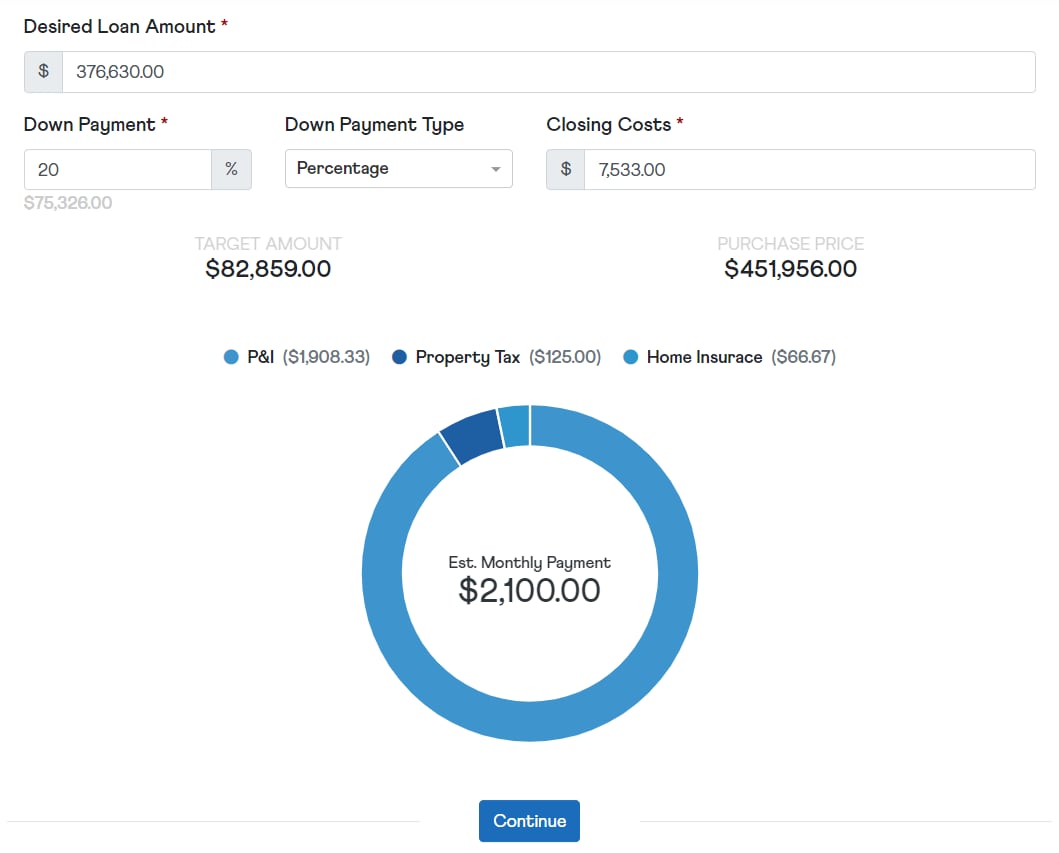

When you select your goal type, you are asked a set of relevant questions designed to emulate the conversation you would have with a coach. For example, a Home Savings goal will have fields to add mortgage details, such as down payments and closing costs. The platform will populate values for you based on your profile and national averages, but you are able to customize goal details for a more accurate projection.

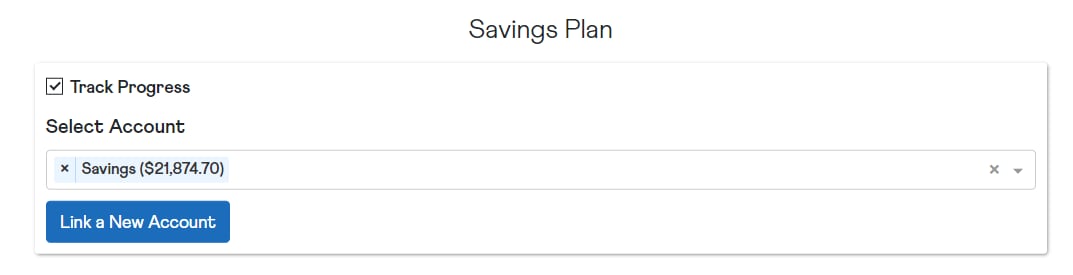

Each goal will have a field to associate a bank account and live-track your progress. Use the drop down menu to select an existing account, or add a new financial account by clicking 'Link a New Account'.

Enter your Monthly Savings, or the amount you pledge to put aside towards this goal each month, and a Target Date will appear. Press 'Save' to save this goal.

Your goals will show on a timeline, listed chronologically by target completion date. As your account balances change, the goal information and target date will automatically update. Savings goals will show how much is 'Saved' and how much is 'Needed', while debt reduction goals will show your outstanding balance and monthly payment. Click 'View details’ to edit or delete a goal.

When you complete a goal, it will show at the bottom of the timeline. The status will show as 'Monitoring' which means it is still connected to an account. If the account balance drops below the goal amount, the goal will go back onto the timeline. Click on the completed goal to edit, delete, or archive it.

Archiving a goal frees up the accounts tied to it so that you can link them to new goals. Please note that you can not make further changes to a goal once it has been archived.

Savings Goals

Emergency Fund

The platform will suggest a savings goal based on your average monthly spending. The savings goal will be 4 - 6 months if you are single and 3 - 5 months if you are married, depending on job security. The suggested amount can be overridden.

Enter your monthly savings amount and link the savings account that will hold your emergency fund. Your current savings plus your monthly savings will determine the target completion date.

College

The college savings goal allows you to choose a specific college’s cost or select a national average to establish your total target savings amount. The calculation will also take into account and adjust for the number of years at the school, education inflation, and the rate of return.

Enter your monthly savings amount and link the savings account that will hold your college savings. Your current savings plus your monthly contribution will project the total target amount by the target completion date.

College goal data is sourced from the Integrated Postsecondary Education Data System.

Home

The maximum loan amount is determined by figuring out your maximum monthly payment, which is a percentage of your income minus your other monthly debt payments. By adjusting mortgage details, which includes term, interest rate, property tax and insurance, the calculation will determine your maximum loan amount, which can be overridden.

Additional fields are available to grant the user the ability to edit down payment amounts and closing costs, among others. These help spur calculations for target amount and purchase price.

Enter your monthly savings amount and link the savings account that will hold your home savings.

Your current savings plus your monthly contribution will determine the target completion date.

Other

The ‘Other’ savings goal will calculate your target completion date based on your current savings (from your linked savings account) plus your additional monthly savings.

Debt Reduction Goals

Credit Card

The credit card debt reduction goal begins with linking one or more credit cards accounts to determine your starting balance - which will include the interest you will accrue before it is fully paid off. If you link more than one credit card, you can choose between the ‘Snowball’ strategy, where you pay off the card with the smallest balance first, or the ‘Avalanche’ strategy, where you pay off the card with highest interest rate first.

The target payoff date will be determined using the minimum monthly payment for your card, plus the additional monthly payment you input.

Auto Loan

The auto loan debt reduction goal will first have you link your auto loan account and adjust the loan details, such as original loan amount, monthly payment, and interest rate. The balance to be paid off will be pulled from your linked account and include the interest you will accrue before it is fully paid off.

The target payoff date will be determined using the required monthly payment for your vehicle, plus the additional monthly payment you input.

Student Loans

The student loan debt reduction goal will first have you link your student loan accounts and adjust the loan details, such as original loan balance, minimum monthly payment, and interest rate. The balance to be paid off will include your current account balance as well as any interest you will accrue before the loans are fully paid off.

The target payoff date will be determined using the required monthly payment for your loan, plus the additional monthly payment you input.

Mortgage

The mortgage debt reduction goal will first have you link your mortgage account and adjust the loan details, such as original loan amount, required monthly payment, and interest rate. The balance to be paid off will include your current account balance as well as any interest you will accrue before the loans are fully paid off.

The target payoff date will be determined using the required monthly payment for your loan, plus the additional monthly payment you input.

Other

The ‘Other’ debt reduction goal will first have you link your applicable loan account and adjust your loan details, such as original debt balance, minimum monthly payment, and interest rate. The balance to be paid off will include your current account balance as well as any interest you will accrue before the loan is fully paid off.

The target payoff date will be determined using the minimum monthly payment for your loan, plus the additional monthly payment you input.